YOU

BUILT

YOUR FUTURE

Now Let's Make it Last

— Tax-Free

YOU BUILT YOUR FUTURE

Now Let's Make it Last — Tax-Free

$1.6 Billion

2025 YTD Retiree Wealth Created

As Featured On

84%

Average Lifetime Wealth Increase

Here's What We Know So Far

Estimates based on conservative asumptions and the information you provided.

Projected Tax-Free Gains

$2.1m - $2.9m

Additional lifetime wealth vs your current IRA trajectory

Conversion Window

6 - 8 Years

Strategic conversion period to convert your IRA to Roth, starting at age 58

Maximum Tax Bracket

22 - 24

Maximum federal tax bracket you'll hit during Roth conversion

More Income, Less Risk

Learn How (Calculator Below)

More Income, Less Risk

We’ll Show You How (Calculator Below)

STEP 1/3: Watch This Short Video

2 Minutes 41 Seconds

STEP 2/3: See if You Qualify for Our Model Q® Strategy

Please Take the Following Survey

What is the Model Q® ROTH Conversion?

Turn Taxable Retirement Accounts Into Tax-Free Income

The Model Q® Roth Conversion Strategy is a tax-optimized approach to retirement planning that transforms your taxable retirement savings into a long-term, tax-free income stream.

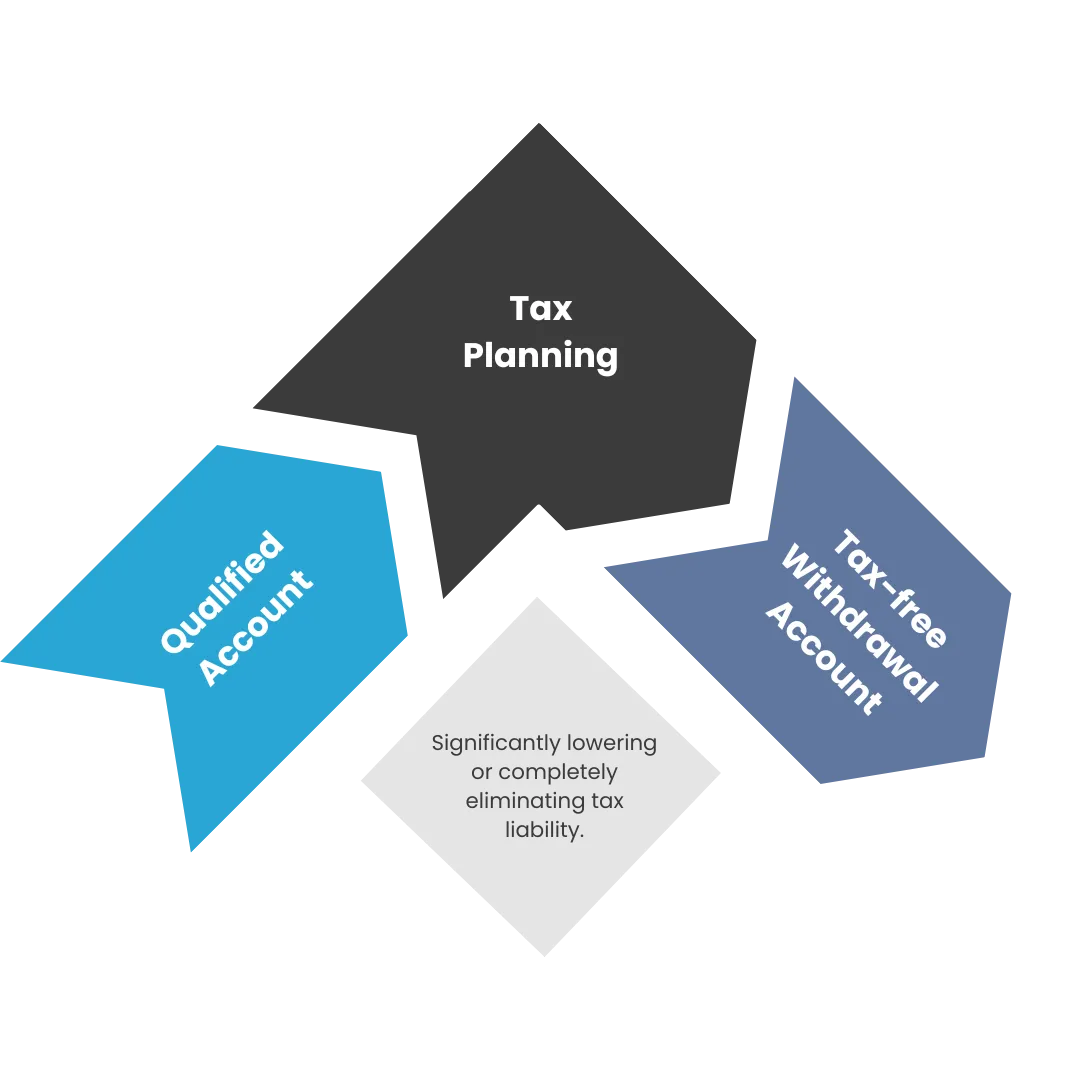

This diagram breaks it down simply:

1. Qualified Account

This is your current retirement account — like a Traditional IRA, 401(k), or SEP IRA — where taxes are deferred until you start withdrawing. Without planning, every distribution could trigger a hefty tax bill.

2. Tax Planning

Using our Q Tax Plan, we aim to minimize or completely offset the tax hit during conversion.

3. Tax-Free Withdrawal Account

Once converted, your funds grow tax-free — and future withdrawals are 100% income-tax-free.

This means:

- No Required Minimum Distributions (RMDs)

- No taxes on gains

- Greater control over your income in retirement

From Tax-Deferred

to Tax-Free

The Model Q® Roth Conversion Strategy offers a clear path from tax-deferred to tax-free — without the shock of a massive tax bill. By planning ahead, you can keep more of what you’ve earned, eliminate Required Minimum Distributions (RMDs), and enjoy total control over your retirement income. If you're serious about building a tax-free future, it’s time to explore how this strategy could work for you. Let’s make your retirement as tax-efficient as it is fulfilling.

From Tax-Deferred to Tax-Free

The Model Q® Roth Conversion Strategy offers a clear path from tax-deferred to tax-free — without the shock of a massive tax bill. By planning ahead, you can keep more of what you’ve earned, eliminate Required Minimum Distributions (RMDs), and enjoy total control over your retirement income. If you're serious about building a tax-free future, it’s time to explore how this strategy could work for you. Let’s make your retirement as tax-efficient as it is fulfilling.

The Model Q® Strategy Calculator

Disclaimer:

The results provided by this calculator are for informational and illustrative purposes only and should not be construed as financial, investment, or tax advice. The figures are based on hypothetical assumptions and estimates that may not reflect actual future outcomes. Actual investment returns, tax rates, and withdrawal amounts may vary and are not guaranteed.

The Model Q® Strategy, Traditional 401(k)/IRA values, and tax implications are simplified and may not account for all relevant financial factors or personal circumstances. You should consult with a qualified financial advisor, tax professional, or retirement planning expert before making any financial decisions.

Past performance is not indicative of future results. This tool does not constitute an offer to sell or a solicitation of an offer to buy any financial product.

Meet The Founders Of The Model Q® Strategy

Kevin Brunner is a seasoned professional with over 20 years of experience in financial services. He has a special focus on doctors and business owners, and has spent over 30 years consulting businesses from startups to turnarounds. His philosophy is that retirement is about income, not assets, because not all assets return the same income.

Kevin was featured as an advisor in Forbes magazine in 2015 and leads a team of professionals, CPAs, and attorneys trained in the principles and strategies of retirement income planning, business planning, wealth preservation, and asset protection.

His goal is to share the blessings he's received, including amazing experiences from visiting 47 countries and counting, learning from tremendous mentors in life and business, and the generosity he's experienced. He was born an orphan, adopted by a loving and generous family, and feels blessed with more than he deserves. He prays to live long enough to give back even a portion of what he has received.

Trevor is a dynamic professional currently serving as the Director of Strategy at CommQuality and COO for Q-financial. Based in Orange, California, Trevor is deeply committed to applying his knowledge and skills in the sales and marketing domain to helping more asset owners became aware of the benefits of the IST process.

His journey in the professional world has seen him lead multiple teams in devising marketing strategies aimed at bolstering the social media presence of various companies, subsequently driving an increase in their sales. Trevor's association with CommQuality is not just professional; it's personal. He joined the company alongside Nate, a close friend and former classmate, and together, they envision transforming CommQuality into a leading marketing agency that enhances competitive advantages for Commercial Brokers and Financial Advisors.

Nathan (Nate) is on a mission to create business partnerships that bring unparalleled client value. His focus is the financial services industry, where he discovered his passion. This led him to develop a partnership-based system tailored for financial companies and commercial brokers.

Nathan is not just about business; he's also actively involved in social media and video editing, helping produce the "TheTaxHax" podcast. He believes in the power of networking and often shares practical lessons from his entrepreneurial journey. From insurance to real estate to marketing, Nathan's diverse experience speaks volumes about the importance of continuous learning and adaptation in today's dynamic business world.

On the educational front, Nathan holds a Bachelor of Science in Marketing/Marketing Management and an Associate's Degree in Business and Personal Financial Services Marketing Operations.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.